Aims & Purpose

This lesson addresses the content understanding:

- PROSPERITY AND DEPRESSION (1920-1939): *The 1920s and 1930s were a time of cultural and economic changes in the nation. During this period the nation faced significant domestic challenges including the Great Depression. *Taken from: New York State K-12 Social Studies Framework (New York State Education Department, 2014), p. 39

- Students will examine:-The background reasons for the tax fraud case brought against Andrew Mellon-Robert H. Jackson’s role in the Andrew Mellon tax case-The results and consequences of the Andrew Mellon tax case-Andrew Mellon’s role in founding the National Gallery of Art in Washington, DC

Concepts

Civic Participation

Due Process of Law

Justice

Skills

- Gathering, Using, and Interpreting Evidence-Identify, describe, and evaluate evidence about events from diverse sources (including written documents, video, and other primary and secondary sources).

- Describe, analyze, and evaluate arguments of others.

- Chronological Reasoning and Causation-Identify, analyze, and evaluate the relationship between multiple causes and effects.

*Taken from: New York State K-12 Social Studies Framework (New York State Education Department, 2014), pp.14, 16

Setting the Stage, Introduction & Background

10 minutes

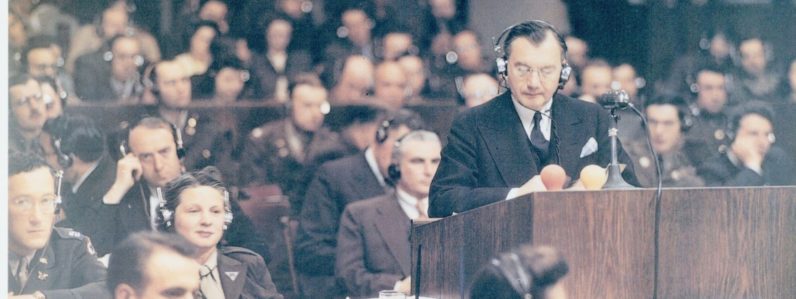

After Robert H. Jackson arrived in Washington, DC in early 1934 to take a leadership position in the Federal Bureau of Revenue, the Justice Department asked his office to prosecute Andrew Mellon, a prominent Pittsburgh businessman, for tax fraud and income tax evasion.

President Franklin D. Roosevelt believed that Andrew Mellon and other wealthy entrepreneurs like him were partly responsible for causing the Great Depression. President Roosevelt called Andrew Mellon “the mastermind among the malefactors of great wealth.”

Robert Jackson supported the tax evasion charge but felt that the tax fraud charge was not supported by the evidence. Jackson argued the tax evasion case for over a year and a half in federal court in Pittsburgh, Pennsylvania. In 1937, Jackson won the case and the verdict required Andrew Mellon to pay over $600,000 in back taxes.

The Andrew Mellon Case

10 minutes

After viewing the segment on the DVD, Liberty Under Law: The Robert H. Jackson Story, about the Andrew Mellon case (11:38-13:04), ask students to summarize the historical background and reasons for the civil tax case. Students can gather additional information about the case by consulting the following sources:

https://mellon.org/about/history/andrew-w-mellon/ Andrew W. Mellon by David Cannadine

http://www.economist.com/node/8077461/ “Andrew Mellon: Made it, bought it, ran it, gave it,” October 26, 2006, The Economist.

The National Gallery of Art

10 minutes

During the tax trial in 1936, Andrew Mellon approached President Franklin Roosevelt with an offer to build a national art gallery in Washington, DC and donate his vast collection of artworks and to endow it. President Roosevelt accepted his offer but made it clear that this donation would have no effect on the outcome of the trial.

As an extension of this lesson, have students visit the website for the National Gallery of Art at www.nga.gov. Students can take a virtual tour and explore the various collections.

Other Historical Examples

15 minutes

As a further investigation of the Mellon case, students can research other historical examples when presidents have used the Internal Revenue Service to threaten or punish political opponents. Students can find out more about this topic at:

http://www.washingtonexaminer.com/treasury-secretary-andew-mellon-the-irs-and-karma/article/2530909

Sean Higgins, “Treasury Secretary Andrew Mellon, the IRS, and karma,” Washington Examiner, May 31, 2013. www.washingtonexamner.com/author/sean-higgins

Gail Russell Chaddock, “Playing the IRS card: Six presidents who used the IRS to bash political foes,” The Christian Science Monitor, May 17, 2013. http://www.csmonitor.com

Concluding Essay

15 minutes

After completing Steps 1-4, students can prepare a concluding essay that summarizes the lessons of the Andrew Mellon case. Students can respond to the questions: What are the enduring lessons of the case against Andrew Mellon? Why are they significant today? What guidance would Robert Jackson give to today’s lawmakers concerning conflicts of interest and ethics issues?